Summary

We are using interest rates to fight inflation, but they are a poor tool. They penalise the poor and young, and actually cause inflation by giving more money to the rich. There are better ways that we can control inflation, by taxing the wealthy more -- which takes some of the burden away from those who can least afford it, and asks the wealthy to shoulder some of the effort.

Currently, we are doing precisely the wrong thing by continuing with the stage three tax cuts, which overwhelmingly benefit the wealthy. These need to be stopped, and new wealth and luxury taxes implemented if we are to control inflation in a remotely equitable manner.

How can Australia fight inflation in a fair way?

Inflation occurs when goods and services become more expensive. When this occurs too quickly it causes big societal problems because people's spending power disappears. Because of this, it is important to reduce inflation. Currently the mechanism by which we are doing this is raising interest rates. This is problematic because

- it is only affecting a subset of Australia

- another subset of Australia benefits from it, and thus tends to engage in more inflationary spending

- it is regressive -- high interest rates affect the young and poor the most.

A quick primer on Modern Monetary Theory

Most people, if they have heard of modern monetary theory at all, think that it is an argument for increasing deficit spending by the government. I believe this is incorrect. MMT is actually a framework for thinking about the government's policy as it pertains to finance and spending - it is not advocating anything at all.

A fiat currency is one that is not tethered to anything. In the past, currencies were often related to precious metals (such as the Roman denarius, which contained a certain amount of silver). In contrast, a fiat currency is just pieces of paper (or numbers on a computer) whose value is literally only what people agree that it is worth. For a government that controls a fiat currency (eg. Australia, UK, USA), the government can literally create money from nothing an spend it. Such governments do this regularly, and have been doing so especially in the last decade of two. For such a government, there is no direct need to tax people in order to spend, because governments can just create new money to spend it on governmental programs.

Here is where the misunderstandings of MMT arise. People erroneously believe that by saying there is no "direct need" that this is a tacit endorsement of governments running up huge debts. MMT is not advocating this (again: MMT is not advocating anything).

However, as I mentioned, it does give a framework for thinking about things:

If governments do not need to tax people in order to spend, then why do they tax?

Governments levy taxes in order to control inflation.

Obviously, if a government is creating lots of additional currency, then there will be a lot more money out there trying to "be spent" on the same pool of goods and services. Supply-and-demand says that if the volume of money is increasing relative to the available goods and services, then the value of the money must decrease. This is called "inflation".

To ameliorate this, governments tax people. In an MMT framework, taxation is effectively the destruction of currency, which helps reduce the amount of money in circulation, and therefore tends to reduce its value relative to available goods and services.

Right now, much of the world is experiencing significant inflation. To try to combat this, central banks have increased interest rates. This is another way to control inflation, because higher interest rates increase the cost of borrowing money (and having debt), and therefore tend to defer spending into the future (high interest rates mean that it's harder to bring spending forward in time by borrowing money).

High interest rates also mean that savers (people with money in the bank) earn more interest on their savings. These high interest rates mean that people with savings are becoming richer, which tends to lead to more spending, which increases inflation. In other words, the very measures that are aiming to reduce inflation (increased interest rates) are also tending to increase inflation.

The social effect of inflation and high interest rates, why the stage 3 tax cuts are ad policy

In Australia, a large number of people are really struggling with inflation, an effective decrease in their wages (relative to prices), and a huge increase in both rent and mortgages. Also, right now, we have bipartisan commitment to stage 3 tax cuts which overwhelmingly benefit large income earners.

Think about this from an MMT framework - tax cuts mean more money floating around, which means the value of the money falls, which means inflation. The strage 3 tax cuts are inflationary -- they are precisely the opposite of what we should be doing.

This is (partly) why the Reserve Bank is having such a difficult time -- the RBA has only one tool they can use (interest rates) to try and bring down inflation, but Australian governments is pushing inflation up with tax cuts (and other policies).

It's vital to understand that we have a certain supply of goods and services available, and that making more money doesn't make more of the things we want to buy.

What is actually occurring, in times of inflation, is a competition for goods and services between different parts of society. Right now the rich are winning.

How else can we control inflation?

Let's consider an alternative response to high inflation. We need to reduce the amount of available money, but we don't want to further impoverish people so we decide to try and reduce the spending of the wealthy (which is mostly discretionary). Instead of raising interest rates so quickly and so far, we could increase income tax for the higher tax brackets (eg. above $150000/pa), remove/reduce negative gearing, and reduce franking credits. If we were feeling adventerous, we could institute a wealth tax. All these measures would reduce the money supply and thus reduce inflation -- and we would have done it without causing so much suffering. Australia would have said to wealthy people "you're still rich, just not as rich as you thought you were"

Sadly, this is not even being discussed.

Instead, what we are seeing is wealth transfer from people who are renting and people with recent mortgages (and little equity in their house) to a much smaller group of people whose wealth is already established and are already rich -- people with a net worth above a couple of million dollars.

Let's put aside the social imperatives for a moment, and consider the environment.

How does this thinking tie-in with our desperate need to decarbonise our society?

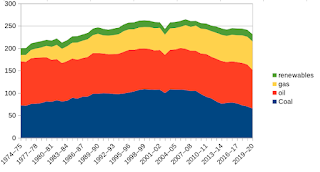

A carbon tax sends a price signal to everyone that we need to reduce our consumption of energy, and also transition from fossil energy to renewable energy. By putting a tax on carbon, we would in effect be preparing ourselves for a future of higher prices. Our failure to retain a carbon tax has not only imposed future environmental costs on ourselves, it also means that we have lost a decade of preparing for higher prices (in fact, as we have seen with the huge increases in enormous diesel cars, we have gone in precisely the wrong direction and are now more vulnerable than ever to price increases).

Let's try and unite the MMT, social, and environmental perspectives.

How could we try and reduce inflation while avoiding the imposition of hardship on people who are already struggling? The important thing is to reduce the money supply, and the easiest way to to that, in a way that doesn't target the poor, is with tax. One approach could be:

- raising tax rates on high income earners

- implementing a carbon tax at $100/ton (importantly, this would help reduce the amount of foreign fuel Australia imports and help maintain the integrity of our currency by improving our balance of trade)

- introducing new taxes to try and reduce the heavy burden that income-earners pay, relative to those with wealth. This might include higher land taxes on non-PPOR, wealth taxes, inheritance taxes, reduction/removal of franking credits.

If some of these measures were taken, we might still have needed interest rate increases, but far fewer than what we have had. We would be taking some of the wealth from the wealthy who have otherwise been out-competing poorer Australians in the competition for goods and services. Also, we would be sending a price signal to prepare for a future of relative energy scarcity, which is coming towards us whether we like it or not.

Final Note:

I am not an economist, nor an expert in modern monetary theory. We desperately need more voices in this economic debate though -- economists largely have significant blind spots when it comes to social, political, technological, and environmental issues. It's worth remembering that, prior to 2022, very few economists thought that a doubling of the money supply might lead to inflation. We need more people to call out high interest rates for the regressive social policies that they are.

Also, while I have an interest in this debate as an engaged Australian who wants to see our country and its people thrive, I am not directly, personally, negatively affected by rising interest rates. I am writing here in what I see as the National Interest, not my personal interest.

Further info:

The Modern Monetary Theory podcast is well worth a listen:

https://pileusmmt.libsyn.com/

David Graeber's 5000 years of debt is an excellent read

Written and published at guesstimatedapproximations.blogspot.com in May 2023 by Angus Wallace

This may be republished with attribution, under a Creative Commons-4.0-BY-SA license license: https://creativecommons.org/licenses/by-sa/4.0/